In a recent article from Senior Wells Fargo Economist, Jay Bryson, the short answer is no. If there is a correction at some point in the future, it will not have the devasting effects that we all experienced in 2006. The rise, he asserts, has to do with fundamental changes rather than on the speculation of the previous bubble. There is a definite, seismic shift in buying trends, household saving and equity positions and more tightly regulated financing.

LOW INVENTORY

Surge in remote work encouraging baby boomers to hold on to their existing homes.

Multi-generational family situation also encourages the baby boomer to stay put.

More disposable income so homeowners are adding-improving existing housing.

The CARES mortgage forbearance act means that fewer short sale/foreclosures are available.

With the surge in the price for building material, new construction is less desirable and less

available.

STRONGER FINANCIAL POSITION OF HOME BUYERS AND HOME SELLERS

Job growth among those earning over $60,000 fell less and recovered more quickly.

Discretionary spending has decreased. These savings have gone to paying down debt, save for

down payments or doing remodeling.

Savings rate toped 7.4% up 3% from the average rate 2003-2007.

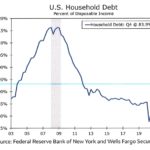

Homeowner debt, at its peak 2007-2009 has significantly dropped.

Record levels of home equity averaging over 66% of value.

INCREASED DEMAND

As Buyers find they can work from home, spending more time there, the push towards larger

homes are evident.

Working from anywhere means Buyers moving to more desirable locations and towards family.

The Millennials are FINALLY in the market, getting married and starting families.

More renters are entering the housing market.

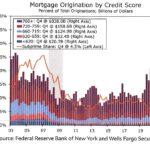

FINANCIAL REGUALTIONS

VERY tight mortgage underwriting. 53% of borrowers have credit scores over 750 and only

6.2% of mortgages were for borrows with scores less than 650.

The household debt service ration which measures the amount of disposable income that

Households need to devote to amortization and interest payments on their debit

Obligations has fallen from 13% to 9%.

Banks are not nearly as leveraged as in the previous bubble.

RECORD low mortgage rates.

In summary, we may at some time in the future experience, a slight correction as the economy improves and interest rates rise but the effect of the correction will not be as evident due to the improved financial stability of hone Buyers and Sellers and the tighter financial lending regulation.